Anomalies in OKEx trading time distributions

Distinct surges in time-of-trade graphs indicate potential scheduled trading bots activity to obfuscate privacy coin laundering. Wash trading can also be a good explanation for such trading patterns. With many exchanges delisting privacy coins, OKEx’s Monero (XMR) and ZCash (ZEC) markets remained active through 2020 with abnormal trading patterns. XMR’s time of trade distribution on OKEx noticeably falls out of the common flow of activity observed on Binance and Huobi.

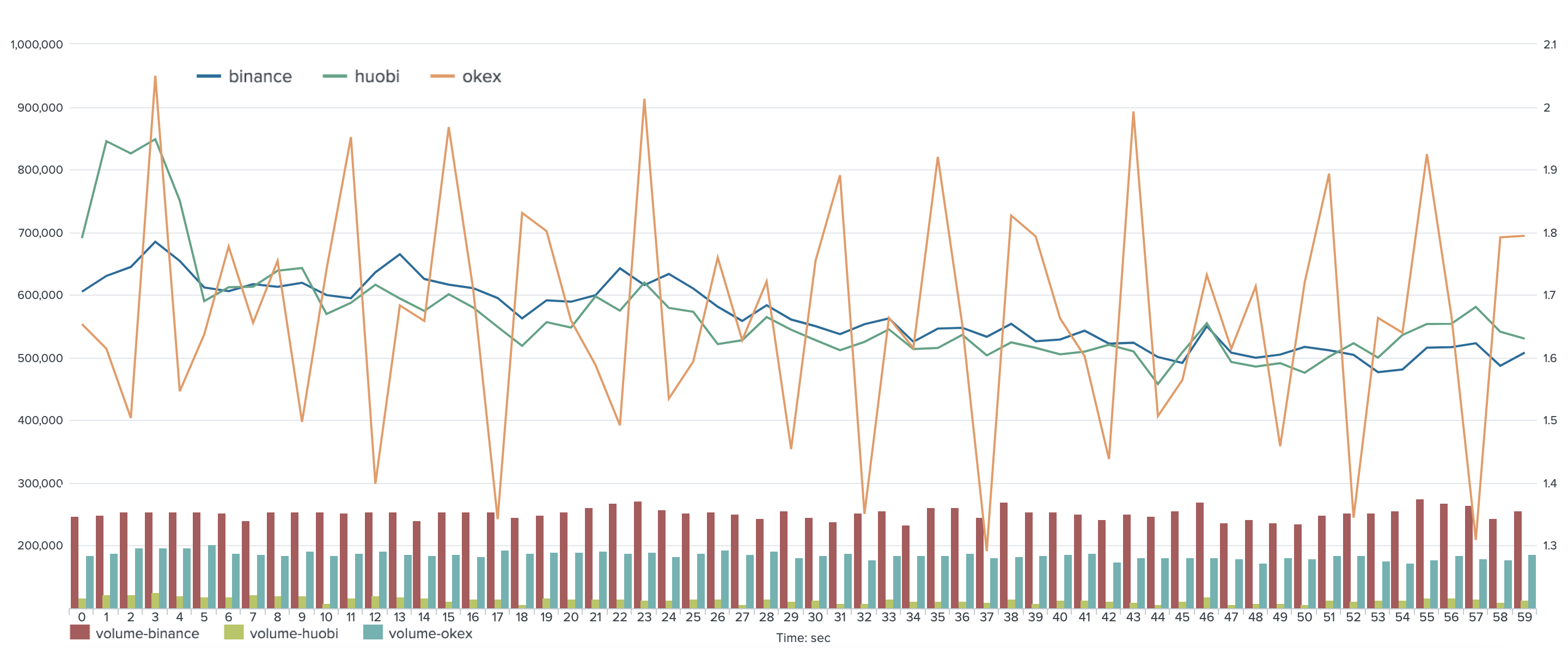

Percent of executed XMR spot trades by seconds on OKEx, Binance, Huobi, 2020.

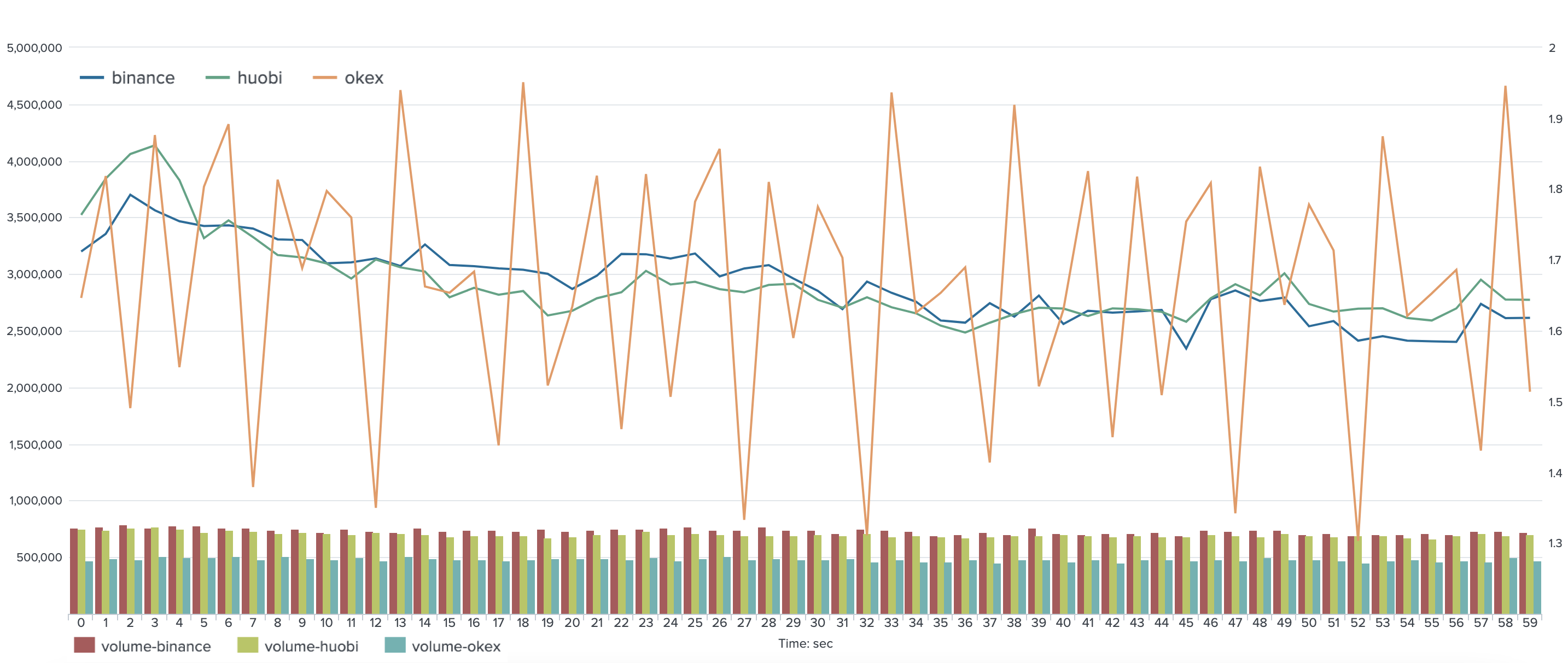

Both XMR and ZEC second-of-trade graphs showed abnormal distributions which indicate that the most active trading happens every 5 seconds. It is important to note that the observed sharp swings in trade volume by second were not caused by shortages in liquidity for these markets.

Percent of executed ZEC spot trades by seconds on OKEx, Binance, Huobi, 2020.

Privacy coins grabbed significant attention due to their anonymous ownership capabilities and subsequent use in darknet markets. The distinct surges in the above graphs may show not only dominant trends in trading bots but also potential trade patterns related to criminal activity. As a result, exchanges such as OKEx may be used as platforms to obfuscate illegal transactions. Wash trading can also be a good explanation for such trading patterns.

Distributed Networks Institute

Distributed Networks Institute